Citygate Global Investment Ltd is an organization founded in June 2007 to engage in Finance business (Microfinance Finance) and registered with Corporate Affairs Commission (CAC).

Citygate Global is a registered member of Association of Non-Bank Microfinance Institution of Nigeria (AMFIN) and also a registered Money Lending Company in all the States where we operate.

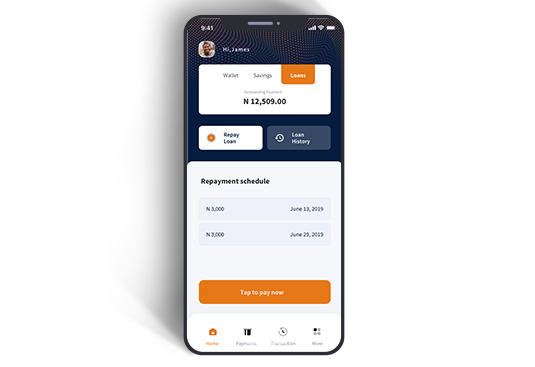

Monéé is a Mobile Loan, Savings, Investment, Bill Payment and Funds Transfer application. It is both a financial service and a financial platform that enhances the quality of its users' lives by giving them a needed financial boost when they need it and by providing a means for them to make targeted Savings and Investment plans.

Learn More

We believe in the power of presence, and we want to be close to those who need us the most. Therefore, we have strategically located our branches where they can be of the most benefit to our customers. Click on the link below to discover just how close we are to you.

Our Branches